Managing a restaurant is more than just serving delicious food. One of the critical aspects that can make or break your business is understanding and effectively managing your Restaurant P&L (Profit and Loss) statement.

It’s a financial document different from balance sheets, that provides a clear picture of your net profits or losses. By understanding how P&L statements work, you can identify specific areas for improvement, make informed decisions, and drive growth in your business.

In this blog, take a look at the essential components of a Restaurant P&L statement and how you can use it for your restaurant business.

Key components of a restaurant P&L statement

1. Sales and revenue

This includes all income derived from your restaurant operations. It covers food and beverage sales, which form the bulk of your revenue.

However, if your restaurant has other business ventures like merchandise sales or catering services, these should also be included in this section.

2. Cost of goods sold (COGS)

COGS is the direct costs associated with producing the goods sold by your restaurant. It includes food ingredients, beverages, kitchen supplies, and any other items directly tied to your menu offerings.

Keeping track of your COGS helps you understand how changes in these costs affect your profitability.

3. Labor costs

Under this category, you’ll include all expenses related to your restaurant staff. This includes:

- Wages

- Salaries

- Payroll taxes

- Employee benefits, etc…

Labor costs can significantly impact your bottom line, so it’s crucial to manage them effectively.

4. Operating expenses

These are the costs associated with running your restaurant on a day-to-day basis. They include:

- Rent

- Utilities

- Property insurance

- Marketing costs

- Maintenance, etc…

This is the most important category because there is a big chance of missing some expenses which can hurt the bottom line of your P&L statement. Understanding how to read a restaurant P&L is crucial for your business growth. By tracking these elements, you can identify where most of your revenue comes from and where your money is going.

Creating and recording a restaurant P&L statement

Creating and recording a restaurant P&L statement is relatively simple – most of these tasks can be done using a spreadsheet program like Excel or Google Sheets. Here is a step-by-step guide to creating one for your restaurant business:

Choose your timeframe: Deciding on the period for your P&L is important. It could be weekly, monthly, quarterly, or annually, depending on how frequently you want to gauge your financial performance. Depending on your business size and volume, choose a timeframe that works best for you.

Record your Sales: Once you have the time frame ready, start recording the total sales, ensuring detailed tracking of different revenue streams such as dine-in, take-out, delivery, and catering (in case you offer). The more precise, the better it will be for your financial understanding.

COGS and labor costs: Next, tally up your expenses – start with the Cost of Goods Sold (COGS) – the cost of the ingredients you use to prepare your dishes. Then, include labor costs, accounting for all wages and salaries paid out to your staff. However, this task can be challenging in a busy restaurant environment – outsourcing restaurant bookkeeping services would be a great idea.

Detailed operating and occupancy costs: Now list down all the expenses associated with running your restaurant. This includes utilities, rent, marketing, maintenance, etc… These costs don’t directly generate revenue but are essential for your restaurant’s operation.

Include Depreciation: Finally, remember to account for depreciation – it represents the decrease in the value of long-term assets like kitchen equipment or furniture over time. Although it doesn’t involve an actual cash outflow, still, it’s an actual expense that must be recorded.

Analyzing a restaurant P&L statement

1. Understanding percentages of sales

2. Calculating gross profit and margin

3. Determining net profit or loss

Subtract your total expenses (including COGS, labor, and operating costs) from your total revenue to determine your net profit or loss. This figure tells you how much money your restaurant is making after all costs are considered.

It can be a complicated task if you are not experienced in financial management. It’ll be a good idea to get restaurant accounting services that offer professional reporting services to help you properly analyze your net profit and loss.

4. Evaluating performance benchmarks

Interpreting a restaurant balance sheet

Lastly, compare your figures against industry benchmarks such as:

- Median revenue per employee: This metric measures how much revenue is generated per employee, allowing you to see how productive your staff is.

- Net profit per employee: If you are making a profit, this metric shows how much you are making per employee. If you have a loss, it indicates how much each employee is costing your business. Again it can be a complicated task to perform so getting help from professional restaurant payroll services would be a good idea.

- Labor cost percentage: This is the percentage of total expenses that go towards labor costs. This metric helps you determine if your staffing levels are in line with industry standards.

- COGS to sales ratio: This metric shows the percentage of your sales that goes towards COGS. It helps you understand if your food and beverage costs are under control.

Tips for analyzing your P&L statement:

- Look for any significant increases or decreases in expenses compared to the previous period

Monitor your overhead costs, such as rent and utilities, and see if there are ways to reduce them without compromising the quality of your services - Find trends that can help you make more informed decisions, such as which menu items are best sellers or which days of the week tend to have higher sales. The goal is to regularly analyze your P&L to identify areas for improvement and make data-driven decisions that can help increase profitability.

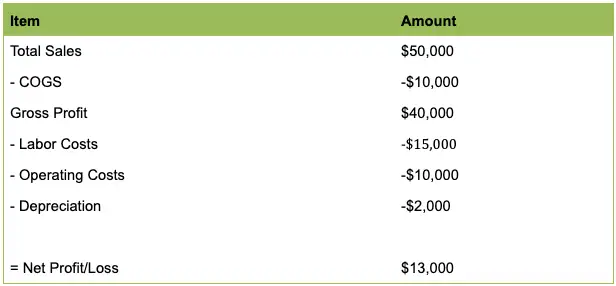

Here is a simplified example of a restaurant P&L statement

In this restaurant P&L example, you start with total sales, then subtract your COGS (Cost of Goods Sold) to calculate your gross profit. Next, you subtract labor costs, operating costs, and depreciation to find your net profit or loss.

When creating a P&L statement, it’s beneficial to use a template with automatic calculations and editable fields. This makes it easy to update numbers and see how changes impact your bottom line.

For instance, if you were to reduce your COGS by negotiating better prices with suppliers, you could easily update the COGS figure and instantly see the effect on your net profit.

As you can see an accurate reading and interpretation of a P&L statement is crucial for any restaurant. It provides an insightful snapshot of your business’s profitability and helps you to make informed decisions about cost-cutting, pricing, and growth strategies.

However, understanding these financial statements can be hard and time-consuming.

At KPI Accounting, we offer restaurant consulting services with premium reporting solutions. From accurate data collection to analyzing and creating visual reports, we’ll help you understand your restaurant’s financial performance and offer insights to improve profitability.

Don’t hesitate to contact us and let us help you understand and analyze your restaurant P&L statement.

FAQs

What sets a P&L restaurant statement apart from other business P&Ls?

A P&L restaurant statement is unique because it includes specific line items, such as food cost and labor cost percentages, and requires regular monitoring.

How can I use a restaurant P&L to optimize my menu pricing?

By understanding your COGS (Cost of Goods Sold) from the P&L, you can better price your dishes to ensure profitability while staying competitive.

Can a P&L example help me forecast future profits?

Yes, by analyzing past P&L statements, you can predict trends and make more accurate forecasts for future profits or losses.

Is there a simple method to calculate P&L in a restaurant?

When it comes to how to calculate P&L, it involves multiple variables, the simplest method is to subtract all costs (COGS, labor, operating costs) from total sales - the result is your net profit or loss.

How often should I review my restaurant's P&L?

Ideally, you should review your restaurant's P&L monthly. Regular reviews help catch issues early and allow for timely adjustments.

Can I use a P&L statement for tax purposes?

Yes, P&L statements are used to calculate the profit or loss of a business and can be used for tax purposes. They provide a clear overview of your restaurant's financial performance, making it easier to report income and expenses accurately for tax filings.